do you have to pay taxes on inheritance in tennessee

The first rule is simple. An inheritance tax is one of several taxes levied in Pennsylvania.

I Just Inherited Money Do I Have To Pay Taxes On It

If you receive property in an inheritance you wont owe any federal tax.

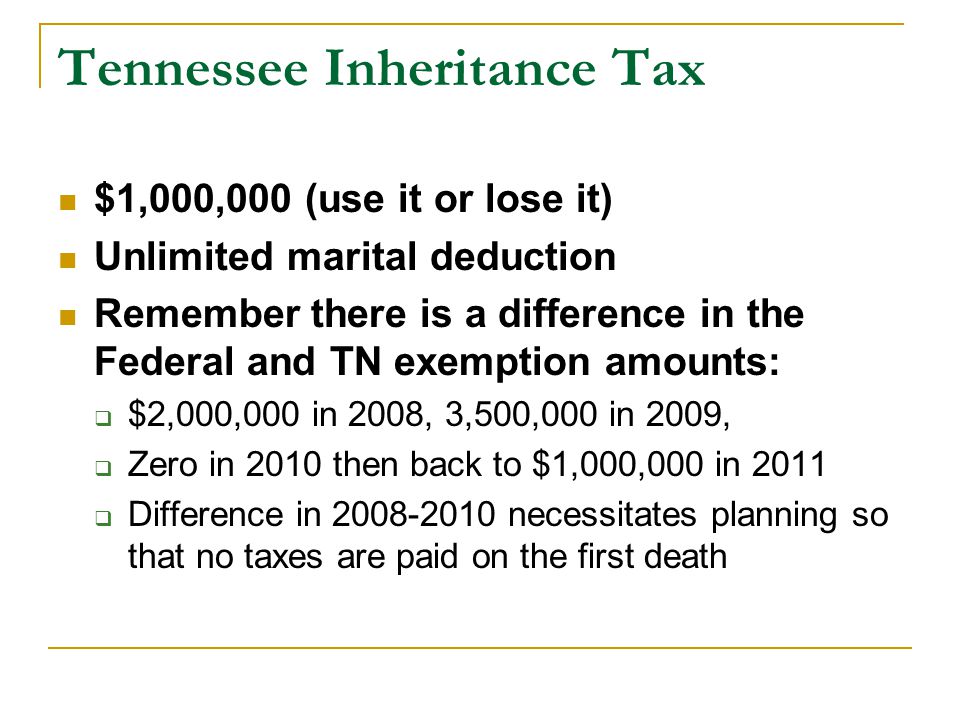

. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. This means that any gift given after that date is not subject to the tax. Even though Tennessee does not have an inheritance tax other states do.

An inheritance tax is a tax on the property you receive from the decedent. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. Be aware of that your assets located in other states may be subject to that localitys inheritance or.

This gift-tax limit does not refer to the total amount you. This tax is only charged by 6 states. Tennessee does not have an estate tax.

Also in this case you need to file Form 709. The inheritance tax is different from the estate tax. Thats because federal law doesnt charge any.

For example if your father-in-law from Tennessee a no-inheritance-tax state leaves you 50000 and you live in say New Jersey a state with an inheritance tax. There are NO Tennessee Inheritance Tax. The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount.

These states have an inheritance tax. The tax is payable at a rate of 33. There is no federal inheritance tax.

The net estate is the fair market value of all. The state income tax rates for the 2021 tax year. Inheritance tax rates differ by the state.

In Ireland the threshold is 30000. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state. Tennessee does not have an estate tax.

Gift and Generation-Skipping Transfer Tax Return. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have. What is the inheritance tax rate in Tennessee.

More importantly people are looking to understand when taxes apply and when people do not have to pay them. This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an inheritance tax. Tennessee Inheritance and Gift Tax.

There are a number of ways to avoid paying inheritance tax on property in Ireland. It allows every Tennessee resident to reduce the taxable part of their. As of 2021 the six states that charge an inheritance tax are.

One way is to gift the. It is one of 38 states with no estate tax. This gift-tax limit does not refer to the total.

There are NO Tennessee Inheritance Tax. When the family owns a house or other real estate the immediate family members pay an inheritance tax of. All inheritance are exempt in the State of Tennessee.

However taxes can be a complicated subject. However gift tax is still owed on gifts given prior to. Who has to pay.

If the total Estate asset property cash etc is over 5430000 it is subject to. At the federal level there is no tax on. Whether or not you have to pay inheritance tax depends on the state you live in the size of the inheritance and your relation to the deceased.

All inheritance are exempt in the State of. The inheritance tax applies to money and assets after distribution to a persons heirs. Inheritance taxes in Tennessee.

Tennessee has updated its tax. Inheritances that fall below these exemption amounts arent subject to the tax. The Tennessee gift tax was repealed effective January 1 2012.

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tennessee Estate Tax Everything You Need To Know Smartasset

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Estate Planning Three Questions You Probably Want Answered How Much Tax Will I Owe When Do I Pay The Tax How Do I Pay The Tax Ppt Download

Tennessee Inheritance Tax Repealed Estate Planning Review Nashville

State Estate And Inheritance Taxes

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

A Guide To Tennessee Inheritance And Estate Taxes

When Do You Probate A Will In Tennessee Shepherd Long Pc

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Money Inheritance Document Pdf Form Fill Out And Sign Printable Pdf Template Signnow

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

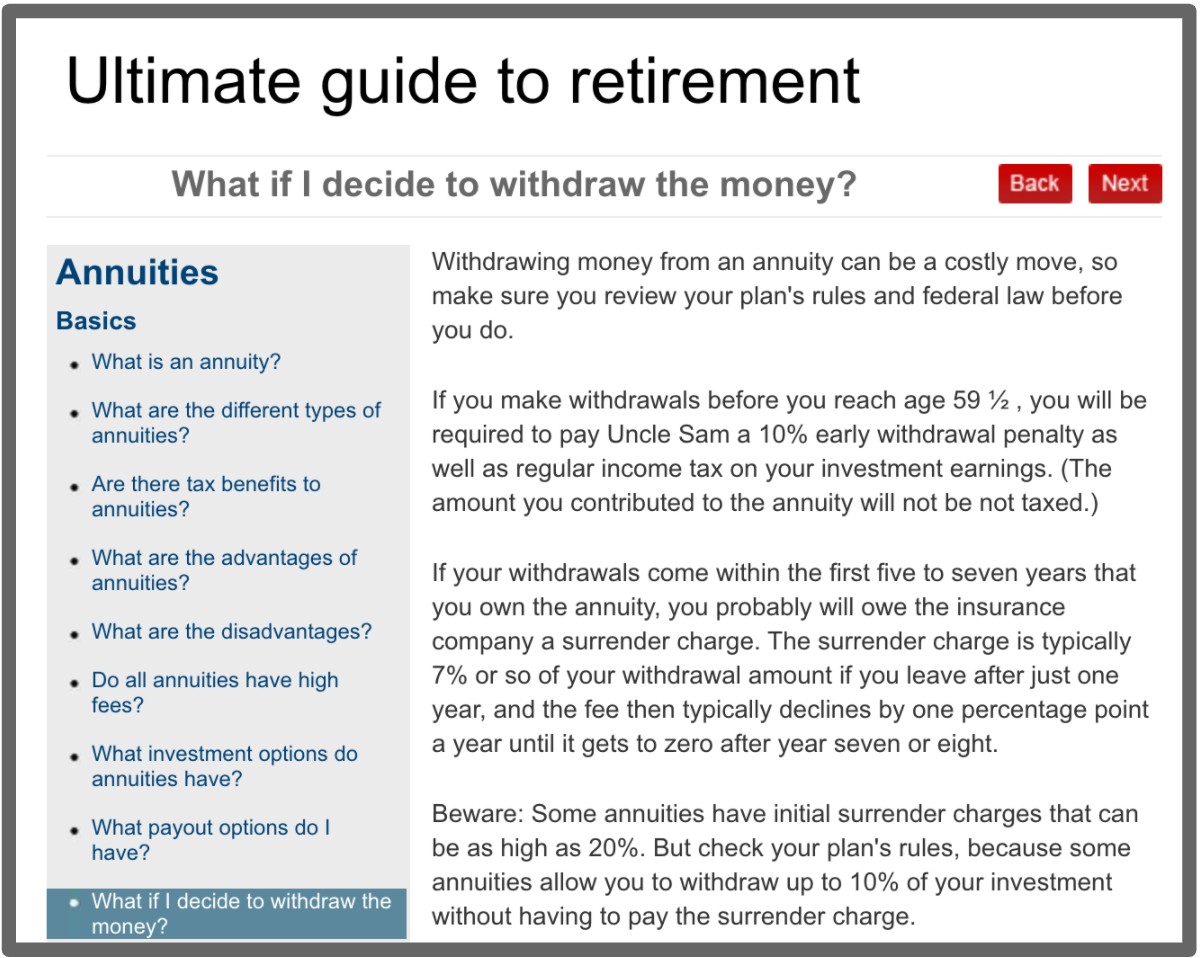

Annuity Tax Consequences Taxes And Selling Annuity Settlements

What Is The Probate Process In Tennessee Epstein Law Firm Blog

What Is An Inheritance Tax And Do I Have To Pay It Ramseysolutions Com

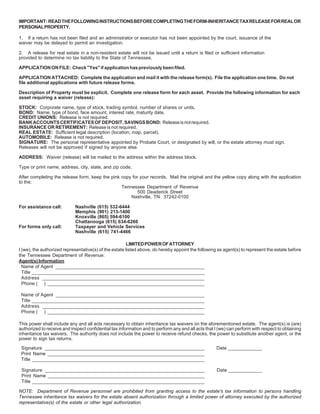

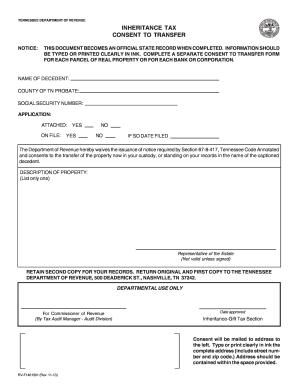

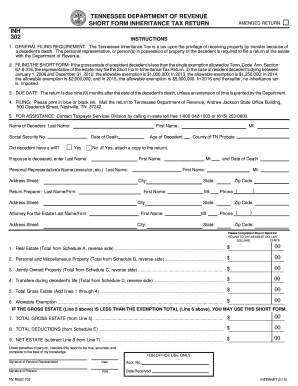

Get And Sign Inheritance Tax Forms 2015 2022

How Much Is Inheritance Tax Community Tax

Inheritance Tax Here S Who Pays And In Which States Bankrate